Prioritizing Your Debts: A Guide to Using Mobile Applications Effectively

Understanding Debt Prioritization

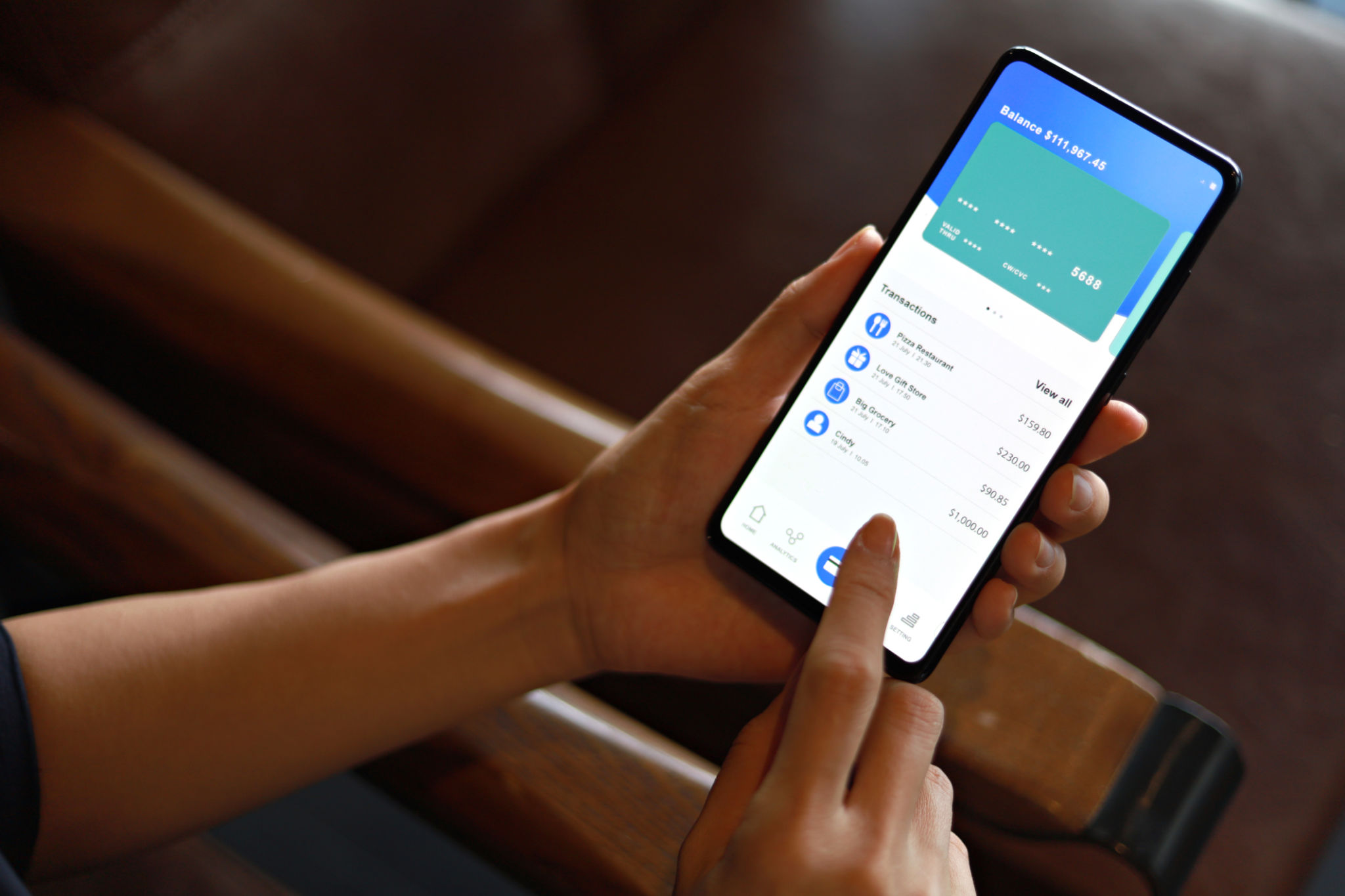

Managing multiple debts can be overwhelming, but prioritizing them is crucial for financial stability. Debt prioritization involves organizing your debts to pay them off in the most efficient manner. By doing this, you can save money on interest payments and reduce financial stress. Mobile applications can be an invaluable tool in this process, offering features that help you stay organized and on track.

The Benefits of Using Mobile Applications

Mobile applications designed for debt management offer several benefits. They allow you to track your debts and monitor your progress effortlessly. With notifications and reminders, you can ensure timely payments, avoiding late fees and penalties. Apps also provide insights into your spending habits, helping you identify areas where you might cut back to allocate more funds toward debt repayment.

Choosing the Right App

There are many debt management apps available, but not all are created equal. When choosing an app, consider its features and ease of use. Look for an app that offers:

- Comprehensive debt tracking

- Payment reminders

- Spending analysis

- Security features to protect your data

Setting Priorities: Which Debt to Tackle First

Once you've chosen an app, the next step is setting priorities for your debts. Generally, it is advisable to focus on high-interest debts first, such as credit card balances, as these accumulate interest quickly. Alternatively, you might choose the snowball method, where you pay off the smallest debts first to gain momentum. Whichever method you choose, consistency is key.

Creating a Repayment Plan

With priorities set, use the app to create a repayment plan. Input all relevant information such as balance amounts, interest rates, and minimum payments. The app can then help you devise a strategy that aligns with your financial goals. Many apps also offer amortization schedules that show how much interest you'll pay over time, helping you make informed decisions.

Staying Motivated and On Track

Staying motivated through the debt repayment process can be challenging. Mobile apps often include features like progress charts and milestones to keep you engaged. Celebrate small victories when you pay off a debt or reach a certain percentage of repayment. These achievements can boost your morale and encourage continued progress.

Regularly Reviewing Your Financial Situation

Your financial situation can change over time due to factors like income fluctuations or unexpected expenses. Regularly review your debts and repayment plan within the app to ensure it still meets your needs. Adjust your strategy as necessary to accommodate any changes in your financial landscape.

The Long-Term Benefits of Debt Management Apps

Effectively managing and prioritizing your debts using mobile applications can lead to long-term financial freedom. As you pay off debts, you'll improve your credit score, reduce financial stress, and potentially save thousands in interest payments. Ultimately, this creates more opportunities for savings and investments in the future.

In conclusion, leveraging mobile applications for debt prioritization is a smart strategy for anyone looking to take control of their financial future. By selecting the right app and staying committed to your repayment plan, you can achieve financial stability and peace of mind.